Faster Quotes, Happier Policyholders – One AI Voice Agent for Insurance

Your policyholders want answers now, but your agents are stuck on the phones answering the same questions about coverage, claims, and renewals. Every call must meet strict compliance and documentation standards without exception.

Consistent, Auditable Call Handling for Insurance Agencies

Dialora is a 24/7 AI voice assistant for insurance agencies that manages routine inquiries, collects quote details, starts claims, and books appointments while keeping every interaction secure, consistent, and fully auditable.

Be the first to respond, engage every prospect immediately & collect preliminary data 24/7.

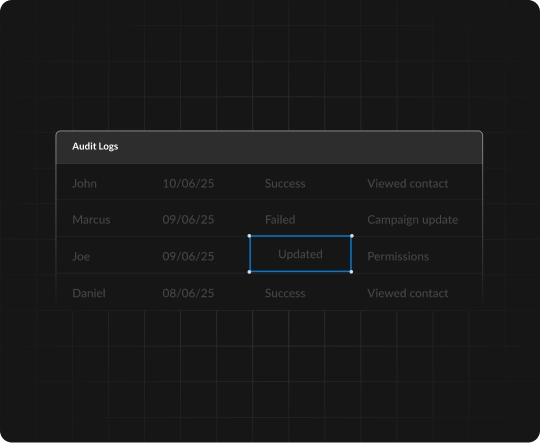

Standardise your claims-taking process with encrypted, SOC 2 logs for a perfect audit trail.

Deploy AI to handle routine renewal reminders and document follow-ups, freeing your licensed staff for high-value advisory work.

Insurance

Dialora Handles Routine

Insurance Calls for You

Dialora uses natural, human-like conversations to manage high-volume repetitive tasks quote intake, claims first notice, policy changes, and renewal reminders without ever binding coverage or giving advice. It integrates with your AMS/CRM systems and escalates complex cases to licensed agents with full context.

What Dialora Does in Your Agency

Prospects and clients can request quotes or schedule renewal reviews anytime. Dialora gathers risk details for auto, home, life, or commercial lines and books qualified appointments so your producers get warm, ready-to-close leads.

Dialora guides first notice of loss, captures essential details, routes claims correctly, and provides status updates on open claims. It also proactively reaches out for payment reminders, renewal notices, and coverage checks to prevent lapses.

Dialora collects information for routine changes like adding vehicles, updating addresses, or issuing certificates of insurance, then triggers your workflows. It identifies gaps and runs targeted cross-sell or referral outreach to grow accounts.

Healthcare‑Grade Security & Clear Boundaries

Dialora is designed for healthcare data from day one, not retrofitted later.

Dialora is purpose-built for regulated insurance operations compliance is never an add-on.

SOC 2-ready platform with customer and policy data encrypted in transit and at rest.

Role-based controls, audit logs, & support for insurance-specific disclosure requirement.

NOTE

Dialora does not bind coverage, make underwriting decisions, or provide legal/financial advice; it escalates those to licensed agents following your rules.

The Impact on Busy Insurance Teams

Agencies using Dialora see more revenue per producer and smoother customer service.

Reduction in manual claims inquiry and policy question calls handled by staff.

Faster quote-to-bind and renewal cycles through instant intake and automated follow-up on open opportunities.

Higher CSAT as callers get quick answers, proactive updates, and fewer transfers for routine requests.

Trusted by Modern Insurance Agencies That Want to Grow

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

FAQs

Yes. Dialora can explain coverage, limits, and deductibles using your approved scripts and knowledge base but does not bind coverage or give legal/financial advice those stay with licensed agents.

Most quotes don’t fail. They just never

get followed up.

We take care of that. If more policies aren’t closing, you walk away.